Practical Export and Import Practitioner - Learning Pathway

The Practical Export and Import Practitioner Learning Pathway provides a structured and practical approach to understanding the key principles of international trade. Designed for professionals involved in the operational aspects of exporting and importing, this pathway equips learners with the essential knowledge and skills to manage Customs compliance, documentation, and logistics effectively within their professional roles and workplaces.

Description

This accreditation offers a comprehensive foundation in export and import procedures, progressing from core concepts to practical applications. It covers the preparation of compliant export paperwork, the management of import arrivals, and the accurate submission of Customs declarations. Recognising that every export is also an import, the pathway ensures learners understand both sides of the trade process. Strong and Herd Learning Pathways are accredited by SFJ Awards, a nationally recognised awarding body.

The Learning Pathway consists of four mandatory modules and three subject-specific optional modules, enabling learners to tailor their education to their professional needs. To further enhance understanding and support learning, a range of supplementary, interactive and self-study resources are included, offering deeper insights into the complexities of international trade.

Our dedicated education support team comprises experienced subject matter experts who actively work within the industry. Several of our international trade specialists hold recognised teaching qualifications, ensuring that our learning approach is academically robust and highly practical, aligning with the ever-evolving landscape of global trade compliance.

Learning Pathway Modules

Mandatory Modules

Beginners Guide to Exporting and Importing

Export Essentials

Import Essentials

Incoterms®2020

Optional Modules (choose three to complete the pathway)

Tariff Classification

Temporary Imports/Temporary Exports

Beginners Guide to Export Licensing

Understanding Free Trade Agreements

Methods of Payment / Letters of Credit

VAT in International Trade

Learning Objectives

The primary objective of this pathway is to provide learners with a solid understanding of core export and import topics. Upon completion, participants will be able to:

-

Prepare and manage compliant export documentation.

-

Control import arrivals to ensure accurate Customs declarations.

-

Understand and apply Incoterms® 2020 Rules appropriately within trade contracts.

-

Navigate Customs and logistics processes effectively to facilitate smooth international trade.

-

Assess and establish company protocols and policies that align with trade compliance best practices.

This training program also explores logistics, Customs, and contractual considerations when arranging international shipments. The optional modules provide additional insights into key topics such as Tariff Classification, Free Trade Agreements, and VAT Compliance, enabling learners to expand their expertise in specific areas relevant to their role.

Upon completing this Learning Pathway, learners will not only have grasped the correct procedures to follow but also possess the capability to assess and establish company protocols and policies. Furthermore, you will be equipped to translate acquired knowledge into actionable practices.

Enrol today to gain an industry-recognised accreditation that will enhance your professional standing and contribute to your organisation’s long-term compliance success.

Who Should Consider this Course?

The Export and Import Practitioner Learning Pathway is designed for individuals currently working in or looking to enter roles involving the operational aspects of international trade. It is ideal for those who want to:

-

Develop a strong understanding of export and import processes.

-

Enhance practical application of trade compliance and logistics.

-

Achieve an industry-recognised accreditation in export and import practices.

This pathway is suitable for trade compliance professionals, logistics managers, freight forwarders, and finance teams responsible for Customs declarations and international shipments.

As the pathway builds from a beginner's perspective, it is suitable for anyone starting their professional pathway that involves now, or may involve in the future, the requirement to understand Customs regulations and compliance matters or individuals looking to enter this area of international trade.

If you require an option to run this Learning Pathway for several employees, please enquire about our group prices. Contact us for further information at enquiries@strongandherd.co.uk

Schedule & Learning Support

70 hours of guided learning across seven modules, with full tutor support.

Includes blended learning resources via a virtual platform, workbooks, and interactive tasks.

All modules are delivered virtually via Zoom, and attendance is mandatory to achieve accreditation.

Each module includes an online assessment consisting of multiple-choice and long-form questions lasting approx. 1 hour per assessment. Each module must be passed to qualify for the Certificate of Achievement accreditation.

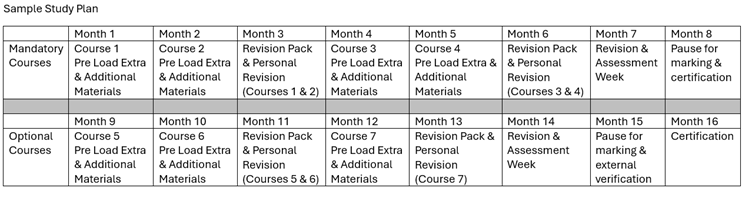

Learning Pathway Duration: We recommend completing your accreditation using a spaced learning approach, allowing time between each course to consolidate your learning and prepare effectively.

Accreditation must be completed within 18 months of enrolment.