AEO Practitioner Qualification Level 3

Covering both Customs Simplifications and Safety & Security this IQ Level 3 Award takes you through the basics of the AEO requirements.

Description

This course is a practical workshop aimed at delegates with experience in International Trade. The aim is to guide you through the top level of customs compliance, which is Authorised Economic Operator.

Covering both Customs Simplifications and Safety and Security, this SFJ level 3 award takes you through the AEO requirements to become fully proficient and qualified to apply for and maintain this HMRC accreditation.

It is updated to reflect the customs legislation of the UK following the exit from the EU, along with an introduction to the Trusted Trader Scheme.

The course is four days, which runs Monday to Thursday or Tuesday to Friday, and covers two days of learning about the Customs Simplifications and two days of learning about Safety and Security. There are two examinations on each topic, both of which you must pass to receive full accreditation.

You will gain a greater understanding of the Three Pillars of Customs Compliance and how these impact businesses; this provides you with advanced knowledge on how to set up business procedures to apply for AEO status. Safety and Security cover a large amount of detail in the AEO application form. This will help you understand the processes and procedures and implement additional security measures for your business.

We will guide you through the practical sessions within each area so you will have a greater understanding of what AEO does for businesses and how to maintain your AEO authorisation by implementing maintenance programs to self-audit within this high level of customs compliance.

This four-day course concentrates on the areas of compliance, and the trainer will guide you through the customs activities on days one and two, plus days three and four will be dedicated to learning the criteria for safety and Security.

As this is a legitimate qualification, the trainers are all qualified adult teachers. They can deliver the training in a correct format, so you receive the best information from qualified adult teachers and competent AEO Practitioners.

Course Framework

UNIT 1: Understanding the Requirements of Customs Compliance within the AEO Standard

- Understand the principles of the AEO scheme and its importance

- Understand the principles of Customs compliance and operations

- Understand the principles of effective Customs management processes

UNIT 2: Application of the Customs Compliance Procedures to AEO Standards

- Understand the principles of the self assessment process

- Apply AEO compliance measures to the business Customs procedures

- Understand what evidence is required and how to gather it

UNIT 3: Understanding AEO-Compliant Security Management Systems within the Supply Chain

- Understand the principles of supply chain vulnerability

- Understand the principles of Security Management Systems

- Understand the security-and safety based considerations for AEO auditors

UNIT 4: Application of Methodology for Ensuring Compliance to Security/Safety Standards

- Understand how to apply identified security threats to business

- Be competent at undertaking Safety and Security Audits

- Understand how to develop countermeasures

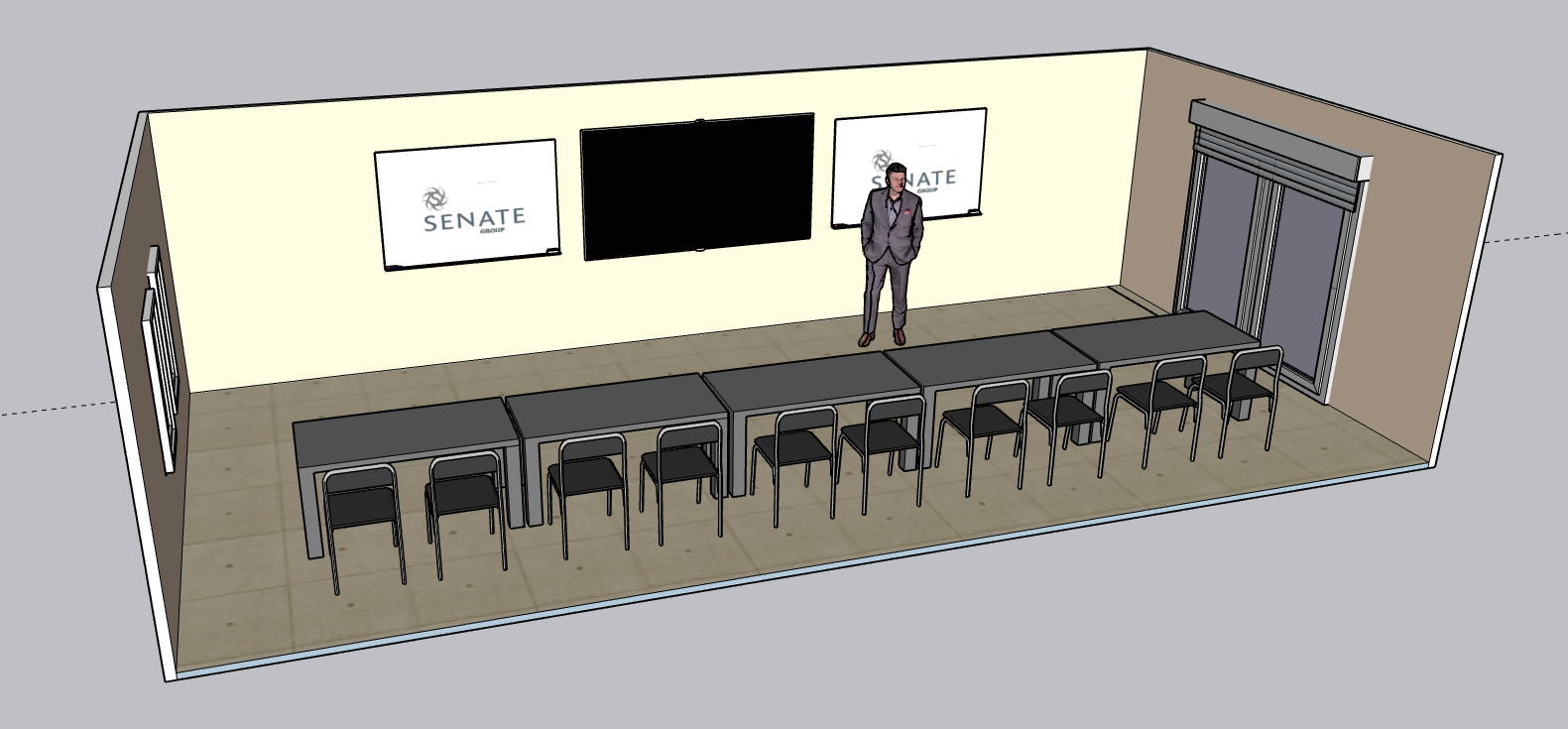

Face to Face Policy

All of our Face to Face training courses are delivered in a Covid-19 secure training room. The safety of our trainers & clients is of upmost importance to us. Our Face to Face courses will be limited to a maximum of 10 delegates.

Pre-Course Procedures and Information

- All learners must ensure they bring with them evidence of a negative LFT test that must be completed no more than 24 hours before you attend site. This can be presented as evidence in the form of a picture of the test itself, or via the registered result on government website. This will be required on each morning of the course you are attending when registering on site.

- If the learner is unable to carry out testing at home, please do inform the venue on 01270 877233 if you require a test on site prior to attending the training. The learner will be required to attend site 30 minutes prior to the course start time to allow this testing to take place.

- Learners who do not bring evidence and refuse to carry out testing on site, will be withdrawn from the course.

- All learners must notify The Senate Group at the earliest opportunity prior to the first day of the course, if the learner or a member of their household manifests any of the recognised signs / symptoms of the Covid-19 virus according to the NHS Covid-19 guidance found at: https://www.nhs.uk/conditions/coronavirus-covid-19/

- Our safety measures include ensuring adequate ventilation of the training room at regular intervals throughout the day so whilst our central heating will be in operation, it is advisable to bring a cardigan / jacket to the course.

Post- Course Procedures

All persons involved with the course including delegates, trainers and Senate employees must sign a document to agree that they will notify The Senate Group should they or anyone in their household develop any of the recognised signs and symptoms of the Covid-19 virus within 14 days of the final day of the course.